Introduction

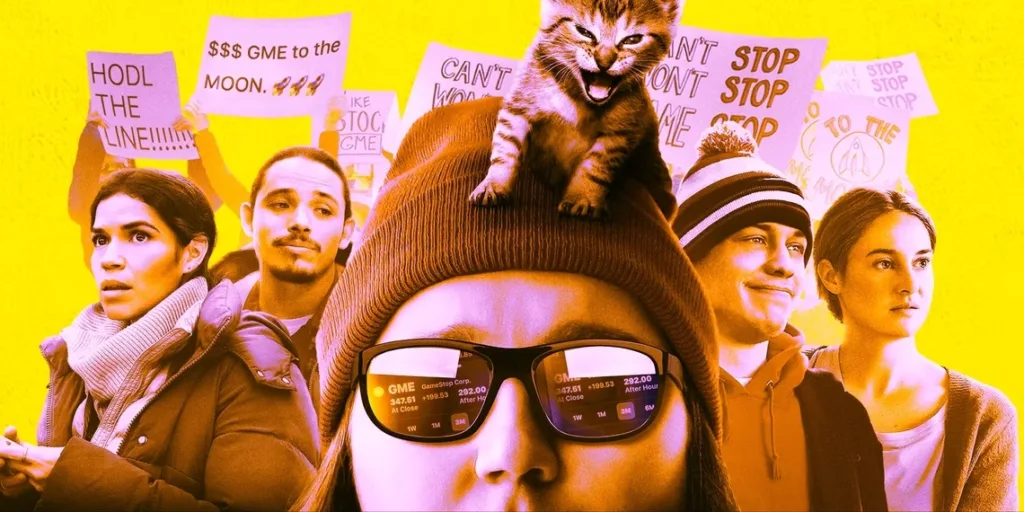

In recent years, the financial landscape has witnessed a fascinating intersection between what is colloquially termed “dumb money” and the burgeoning industry of streaming services. As streaming platforms soared in popularity, attracting millions of subscribers worldwide, they also became the subject of intense speculation and investment from individuals often characterized as “dumb money” investors.

Table of Contents

The Rise of Streaming Platforms

Streaming platforms have revolutionized the way we consume entertainment. With the advent of Netflix in the late 1990s, followed by the explosion of similar services like Amazon Prime Video, Hulu, and Disney+, consumers gained unprecedented access to a vast library of movies, TV shows, and original content at their fingertips.

What is Dumb Money?

Before delving into the convergence of dumb money and streaming, it’s essential to understand what exactly constitutes “dumb money.” In finance, dumb money refers to investments made by individuals who lack experience or understanding of the market fundamentals. These investors often follow trends or rely on hearsay rather than conducting thorough research or analysis.

The Convergence: Dumb Money and Streaming

The allure of high-growth tech industries, coupled with the mainstream popularity of streaming services, attracted a significant influx of dumb money investments into companies within this sector. From small startups to established giants, streaming platforms became a magnet for speculative capital seeking quick returns.

Examples abound of dumb money pouring into streaming-related ventures, driving up stock prices to dizzying heights. However, the intersection of dumb money and streaming hasn’t always resulted in success stories.

Financial Folly Unveiled: Case Studies

Two prominent case studies shed light on the pitfalls of blindly following market trends without conducting proper due diligence.

Case Study 1: The Rise and Fall of MoviePass

MoviePass once hailed as a disruptor in the movie theater industry, allowed subscribers to watch unlimited movies for a flat monthly fee. Despite its initial popularity and backing from high-profile investors, MoviePass faced mounting financial challenges and ultimately filed for bankruptcy in 2019. Dumb money investments couldn’t save it from its unsustainable business model.

Case Study 2: Quibi’s Short-Lived Journey

Quibi, a mobile-first streaming platform offering short-form content, attracted substantial funding from renowned investors before its launch in 2020. However, despite ambitious plans and a star-studded lineup of content creators, Quibi failed to gain traction with consumers and shut down within a year of its inception.

Lessons Learned

These cautionary tales underscore the importance of conducting thorough research and analysis before investing in any venture, particularly within the fast-paced and ever-evolving landscape of streaming services. While dumb money investments may create short-term hype and volatility, sustainable success relies on a solid foundation of sound business fundamentals.

Future Outlook

Looking ahead, the future of streaming platforms remains promising, albeit with challenges and uncertainties. As the industry continues to evolve, investors must differentiate between fleeting trends and sustainable growth opportunities. While dumb money may fuel initial excitement, it’s ultimately the smart money that steers the course toward long-term success.

Conclusion

The intersection of dumb money and streaming services offers a fascinating glimpse into the dynamics of modern finance and entertainment. While speculative investments may inject temporary excitement into the market, prudent decision-making based on thorough analysis and due diligence remains paramount for long-term success.

1: Reflecting on the Intersection of Finance and Entertainment

In closing, the entwined narratives of dumb money and streaming platforms offer a multifaceted glimpse into the intricate dance between finance and entertainment. As investors navigate the ever-shifting tides of market speculation, it becomes increasingly clear that sustainable success hinges on a delicate balance of prudence and innovation. While the allure of quick gains may tempt some towards speculative fervor, the enduring legacy of streaming lies in its ability to captivate audiences with compelling content while delivering value to stakeholders. In this evolving landscape, the lessons gleaned from the intersection of dumb money and streaming serve as a poignant reminder of the importance of discernment, foresight, and resilience in shaping the future of both industries.

2: Embracing a New Era of Investment Realism

In the grand tapestry of financial history, the saga of dumb money meeting streaming stands as a cautionary tale, but also as a testament to the resilience of innovation. As we bid farewell to the era of unfounded hype and speculative excess, a new dawn emerges—one defined by sober analysis, tempered optimism, and a renewed commitment to sustainable growth. The failures of MoviePass and Quibi serve not as epitaphs of defeat, but as signposts guiding us towards a future where prudence reigns supreme and genuine value creation takes precedence. In this era of investment realism, the convergence of finance and entertainment heralds not only a new chapter but a renaissance—a time when sound judgment and calculated risk-taking pave the way for enduring prosperity.

3: Finding Harmony Amidst Market Noise

As the curtain falls on our exploration of dumb money and streaming, we are left with a profound appreciation for the complexities inherent in the intersection of finance and entertainment. Amidst the cacophony of market noise and fleeting trends, a symphony of opportunity emerges—one that resonates with the harmonious blend of innovation and pragmatism. While the allure of speculative fervor may tempt us with promises of overnight success, the enduring legacy of streaming lies in its ability to captivate hearts and minds with captivating narratives and transformative experiences. As we venture forth into uncharted territory, let us heed the lessons of the past, embracing a future where wisdom triumphs over folly, and where the pursuit of value creation transcends the ephemeral allure of momentary gains.

Unique FAQs

- What role does speculation play in the success of streaming platforms? Speculation can contribute to short-term fluctuations in stock prices and market sentiment surrounding streaming companies. However, sustainable success relies on factors such as content quality, subscriber growth, and business strategy.

- How can investors differentiate between smart and dumb money investments in the streaming industry? Investors should scrutinize the underlying rationale behind investment decisions, focusing on factors like market research, competitive analysis, and the track record of the individuals or firms making the investments.

- Are there any indicators that a streaming platform may be vulnerable to financial folly? Warning signs may include excessive hype without corresponding subscriber growth, unsustainable business models reliant on continuous cash infusions, and lack of a clear path to profitability.

- What lessons can entrepreneurs learn from the failures of MoviePass and Quibi? Entrepreneurs should prioritize sustainable business models, listen to customer feedback, and remain agile in responding to market dynamics. Additionally, fostering a culture of innovation and adaptability is crucial for long-term success.

- How can consumers contribute to the success of streaming platforms beyond subscribing? Beyond subscribing to their favorite platforms, consumers can support content creators, provide feedback on content preferences, and actively engage with the community to help shape the future direction of streaming services.

- 6. How do regulatory changes and market competition impact the streaming industry’s susceptibility to dumb money investments?

- Regulatory changes and market competition play significant roles in shaping the streaming industry’s landscape and its susceptibility to dumb money investments. Regulatory changes, such as antitrust scrutiny or changes in intellectual property laws, can introduce uncertainty and affect investor sentiment. Additionally, increased competition from new entrants or established players can impact market dynamics, leading to fluctuations in stock prices and investor behavior. Smart investors closely monitor regulatory developments and competitive pressures to assess the long-term viability of streaming investments.

- Answer: Regulatory changes and market competition exert considerable influence on the streaming industry’s vulnerability to dumb money investments. For instance, when regulatory bodies impose stricter guidelines or scrutinize mergers and acquisitions within the streaming sector, investors may react by adopting a more cautious approach. Similarly, heightened competition from both traditional media conglomerates and emerging streaming platforms can create a volatile environment, where short-term gains may give way to long-term uncertainty. Smart investors recognize the importance of staying abreast of regulatory shifts and competitive dynamics, leveraging this knowledge to make informed decisions and mitigate risks associated with dumb money investments.

- 7. How do cultural shifts and changing consumer preferences impact the success or failure of streaming platforms targeted by dumb money investments?

- Cultural shifts and evolving consumer preferences wield considerable influence over the success or failure of streaming platforms, especially those targeted by dumb money investments. As societal norms and tastes evolve, streaming services must adapt their content offerings to remain relevant and appealing to diverse audiences. Platforms that fail to anticipate or respond to these shifts risk alienating subscribers and losing market share. Dumb money investments in such platforms may exacerbate financial losses if they overlook the nuances of changing consumer behavior.

- Answer: Cultural shifts and evolving consumer preferences represent pivotal factors shaping the trajectory of streaming platforms, particularly those that attract dumb money investments. For instance, as society becomes increasingly attuned to issues of diversity and representation, streaming services must diversify their content libraries to reflect these values and cater to a broader audience. Failure to do so not only risks alienating potential subscribers but also exposes platforms to reputational damage and financial losses. Dumb money investors who disregard these cultural nuances may inadvertently exacerbate the challenges faced by struggling platforms, amplifying the impact of their misguided investments.

- 8. How do technological advancements and disruptions influence the investment landscape for streaming platforms and the behavior of dumb money investors?

- Technological advancements and disruptions wield significant influence over the investment landscape for streaming platforms and the behavior of dumb money investors. Innovations such as artificial intelligence, augmented reality, and blockchain have the potential to revolutionize content creation, distribution, and monetization within the streaming industry. Platforms that embrace these technologies stand to gain a competitive edge, attracting both smart and dumb money investments. However, disruptive innovations can also introduce uncertainty and volatility, leading to erratic investment behavior and speculative bubbles.

- Answer: Technological advancements and disruptions represent double-edged swords in the investment landscape for streaming platforms, exerting both positive and negative impacts on the behavior of dumb money investors. On one hand, platforms that leverage cutting-edge technologies to enhance user experience and streamline operations may attract speculative investments from individuals seeking to capitalize on emerging trends. Conversely, disruptive innovations can introduce volatility and uncertainty, leading to erratic investment behavior and speculative bubbles. Smart investors carefully assess the long-term implications of technological advancements, distinguishing between genuine value creation and fleeting market hype, while dumb money investors may succumb to the allure of short-term gains without fully understanding the underlying fundamentals.

- How do streaming platforms attract dumb money investors, and what are the consequences of such investments? Streaming platforms often attract dumb money investors through a combination of hype, perceived growth potential, and the allure of the entertainment industry. These investors may be enticed by headlines touting explosive subscriber growth or the signing of lucrative content deals. However, the consequences of such investments can be significant. While initial influxes of capital may drive up stock prices temporarily, they can also create artificial bubbles that eventually burst, leading to steep declines in share value. Additionally, the presence of dumb money investors may distort market fundamentals, making it difficult for savvy investors to accurately assess the true value of streaming companies.

- What role does the media play in perpetuating the cycle of dumb money investments in streaming platforms? The media plays a crucial role in shaping investor sentiment and influencing market trends, particularly in industries like streaming where public perception can have a significant impact on stock prices. Sensationalist headlines and breathless coverage of streaming-related developments can contribute to a herd mentality among investors, driving up demand for shares of streaming companies even in the absence of tangible fundamentals. This, in turn, can attract more dumb money investors looking to capitalize on perceived momentum, further fueling the cycle of speculation and volatility.

- Are there any regulatory measures in place to protect investors from the risks associated with dumb money investments in streaming platforms? While financial regulators may intervene in cases of blatant fraud or market manipulation, there are limited regulatory measures specifically targeting dumb money investments in streaming platforms. In most cases, investors are responsible for conducting their own due diligence and assessing the risks associated with any investment opportunity. However, regulators may issue warnings or advisories cautioning investors against following speculative trends blindly and encouraging them to seek out reliable sources of information before making investment decisions.

- How can streaming companies mitigate the influence of dumb money investors on their stock prices and market dynamics? Streaming companies can take several steps to mitigate the influence of dumb money investors on their stock prices and market dynamics. One approach is to focus on transparent communication and disclosure practices, providing investors with clear insights into the company’s long-term strategy, financial health, and growth prospects. Additionally, companies can prioritize building strong relationships with institutional investors and analysts who are more likely to conduct thorough research and analysis before making investment decisions. By fostering a culture of transparency and accountability, streaming companies can help ensure that their stock prices reflect underlying fundamentals rather than speculative hype.

- What are some warning signs that a streaming platform may be attracting excessive attention from dumb money investors? Warning signs that a streaming platform may be attracting excessive attention from dumb money investors include extreme volatility in its stock price, disproportionate media coverage relative to its actual performance, and a disconnect between market sentiment and underlying fundamentals. Additionally, investors should be wary of promotional tactics such as celebrity endorsements or aggressive marketing campaigns that seek to capitalize on hype rather than substance. By remaining vigilant and conducting thorough research, investors can better identify and avoid potential pitfalls associated with following speculative trends in the streaming industry.

FAQs

- What exactly is “dumb money,” and how does it relate to the streaming industry? Dumb money refers to investments made by individuals or groups lacking expertise or understanding of market fundamentals. In the context of the streaming industry, dumb money often manifests as speculative investments driven by hype, trends, or hearsay rather than sound financial analysis. These investors may be attracted to the perceived glamour of the entertainment sector or the promise of quick returns without fully comprehending the underlying risks or dynamics of the market. Long Answer: Dumb money investors in the streaming industry may include amateur traders, retail investors, or even institutional investors who follow trends without conducting thorough research or analysis. They may be drawn to streaming platforms based on media hype, celebrity endorsements, or anecdotal evidence of success without fully understanding the complexities of the market or the specific challenges facing individual companies. As a result, their investments can contribute to market volatility, distort stock prices, and create artificial bubbles that eventually burst, leading to significant losses for themselves and other investors.

- What are some examples of dumb money investments in the streaming industry, and what were the outcomes? Dumb money investments in the streaming industry can take various forms, ranging from speculative stock purchases to funding rounds for ambitious startups. Examples include investors pouring money into companies with unproven business models, unsustainable growth trajectories, or flawed strategies based on unrealistic assumptions about consumer behavior or market dynamics. Long Answer: One notable example of dumb money in the streaming industry is the rise and fall of MoviePass, a subscription-based service that allows users to watch unlimited movies in theaters for a flat monthly fee. Despite initial excitement and backing from high-profile investors, MoviePass struggled to turn a profit due to its unsustainable business model and ultimately filed for bankruptcy in 2019. Similarly, Quibi, a short-form streaming platform launched with much fanfare and significant investment, failed to gain traction with consumers and shut down within a year of its launch. In both cases, dumb money investments fueled initial hype but failed to deliver sustainable long-term success, highlighting the risks of following speculative trends in the streaming industry.

- What are the potential consequences of following dumb money trends in the streaming industry for both investors and the broader market? Following dumb money trends in the streaming industry can have significant consequences for investors and the broader market alike. For investors, blindly following speculative trends can lead to substantial financial losses, as inflated stock prices eventually correct to reflect underlying fundamentals. Additionally, the presence of dumb money investors can distort market dynamics, making it difficult for savvy investors to accurately assess the true value of streaming companies and make informed investment decisions. Long Answer: Beyond individual investors, the consequences of following dumb money trends in the streaming industry can ripple throughout the broader market, contributing to increased volatility, reduced market efficiency, and heightened systemic risk. Artificially inflated stock prices driven by speculative excess can create instability and uncertainty, making it harder for companies to raise capital or plan for long-term growth. Moreover, the failure of high-profile streaming ventures funded by dumb money investors can undermine confidence in the sector as a whole, leading to a loss of investor trust and dampening future investment prospects. In this way, the consequences of following dumb money trends in the streaming industry extend far beyond individual investors to impact the health and stability of the entire market ecosystem.

- How can investors differentiate between legitimate investment opportunities in the streaming industry and speculative traps fueled by dumb money? Differentiating between legitimate investment opportunities and speculative traps in the streaming industry requires careful analysis and due diligence. Investors should look beyond surface-level indicators like media hype or celebrity endorsements and instead focus on factors such as a company’s business model, competitive positioning, financial performance, and growth prospects. Long Answer: Legitimate investment opportunities in the streaming industry are typically characterized by factors such as a proven track record of success, a sustainable business model supported by strong revenue streams, a competitive moat that protects against new entrants or disruptive technologies, and a management team with a clear vision and execution strategy. Conversely, speculative traps fueled by dumb money tend to lack these critical attributes, relying instead on hype, speculation, and unrealistic promises of exponential growth. By conducting thorough research and analysis, consulting with trusted advisors, and staying vigilant against the allure of speculative trends, investors can avoid falling victim to dumb money traps and instead focus on building a diversified portfolio of sound investments with long-term growth potential.

- What measures can regulators and industry stakeholders take to mitigate the risks associated with dumb money investments in the streaming industry? Regulators and industry stakeholders can take several measures to mitigate the risks associated with dumb money investments in the streaming industry, including increased transparency and disclosure requirements, enhanced investor education and awareness initiatives, and stricter enforcement of securities laws and regulations. Long Answer: Regulators can play a critical role in safeguarding investors and maintaining market integrity by implementing measures such as requiring companies to provide more transparent and accurate disclosures about their financial performance, business operations, and risk factors. Additionally, regulators can enhance investor education and awareness initiatives to help individuals better understand the risks associated with investing in speculative markets and empower them to make informed decisions. Industry stakeholders, including streaming companies, investment firms, and media outlets, can also contribute to risk mitigation efforts by promoting responsible investing practices, providing unbiased information and analysis, and fostering a culture of accountability and transparency. By working together, regulators and industry stakeholders can help protect investors and maintain confidence in the streaming industry as a viable investment opportunity for the long term.