Introduction to PayTM: Pioneering Digital Payments in India

PayTM, an acronym for “Payment Through Mobile,” has become synonymous with digital payments in India. Launched in 2010, PayTM has transformed from a fledgling startup to a behemoth in the digital payment realm. Let’s delve into the captivating journey of PayTM and uncover the secrets behind its meteoric rise.

In a rapidly evolving digital landscape, PayTM stands as a testament to the transformative power of technology. Founded in 2010 by Vijay Shekhar Sharma, PayTM emerged as a beacon of innovation in India’s burgeoning fintech sector. With a vision to democratize digital payments and empower millions, PayTM embarked on a remarkable journey that would reshape the way Indians transact.

From its humble beginnings as a mobile recharge platform to its current status as India’s leading digital payment ecosystem, PayTM has consistently pushed the boundaries of possibility. By harnessing the ubiquity of smartphones and the convenience of mobile wallets, PayTM revolutionized the way individuals conduct financial transactions, ushering in a new era of cashless commerce.

Despite facing formidable challenges, including regulatory hurdles and entrenched competition, PayTM remained steadfast in its commitment to driving financial inclusion and fostering economic empowerment. Through relentless innovation, strategic partnerships, and a relentless focus on user experience, PayTM not only overcame obstacles but also thrived in an increasingly competitive market landscape.

As we delve into the captivating journey of PayTM, we unravel the intricate tapestry of innovation, resilience, and vision that propelled this once-nascent startup to the forefront of India’s digital payment revolution. Join us as we uncover the untold story behind PayTM’s meteoric rise and explore the key milestones, challenges, and triumphs that have defined its remarkable trajectory.

Table of Contents

The Inception of PayTM

PayTM was founded by Vijay Shekhar Sharma with the vision of revolutionizing the way Indians transact digitally. Inspired by the concept of cashless transactions, Sharma embarked on a journey to create a platform that would simplify payments for millions.

The Inception of PayTM: A Visionary Venture Redefining Digital Payments

The inception of PayTM marked a pivotal moment in India’s digital landscape, driven by the visionary zeal of its founder, Vijay Shekhar Sharma. Born out of a fervent desire to revolutionize the way Indians transact digitally, PayTM’s journey began with a bold vision and a relentless pursuit of innovation.

Vijay Shekhar Sharma’s entrepreneurial journey is a testament to grit, determination, and unwavering conviction. Hailing from humble beginnings in rural India, Sharma’s entrepreneurial spirit was ignited at a young age, fueled by a deep-seated passion for technology and a burning desire to make a difference.

Armed with a potent combination of technical prowess and business acumen, Sharma embarked on a journey to carve a niche in India’s burgeoning fintech sector. The idea for PayTM crystallized from his own experiences and observations of the challenges faced by ordinary Indians in accessing financial services.

In 2010, amidst a landscape dominated by cash transactions, Sharma conceived the idea of a mobile-centric payment platform that would empower users to conduct transactions seamlessly using their smartphones. Thus, PayTM, an acronym for “Payment Through Mobile,” was born, with a mission to democratize digital payments and foster financial inclusion on a massive scale.

The early days of PayTM were characterized by audacity and innovation, as Sharma and his small team worked tirelessly to bring their vision to life. From developing the initial prototype to securing funding and navigating regulatory hurdles, every milestone was a testament to their unwavering resolve and entrepreneurial spirit.

Despite facing skepticism from traditional players and regulatory challenges, Sharma remained undeterred, fueled by an unshakeable belief in the transformative power of technology. PayTM’s early success can be attributed to its ability to identify and capitalize on emerging trends, such as the proliferation of smartphones and the growing demand for digital services.

As PayTM gained traction among users, its offerings expanded beyond mobile recharges to encompass a wide range of services, including bill payments, ticket bookings, and online shopping. This diversification not only broadened PayTM’s user base but also solidified its position as a one-stop solution for all digital payment needs.

The inception of PayTM marked the beginning of a paradigm shift in India’s digital payment landscape, catalyzing a wave of innovation and transformation that continues to reverberate to this day. What started as a humble startup has now evolved into a juggernaut in the fintech space, disrupting traditional modes of commerce and empowering millions with the freedom to transact anytime, anywhere.

In essence, the inception of PayTM is not just a chapter in India’s entrepreneurial saga but a testament to the power of vision, perseverance, and innovation. As PayTM continues to chart new frontiers and redefine the future of digital payments, its inception remains a beacon of inspiration for aspiring entrepreneurs and innovators worldwide.

Challenges Faced by PayTM in its Early Days

In its nascent stages, PayTM encountered numerous challenges, including skepticism about digital payments, regulatory hurdles, and fierce competition from established players. However, undeterred by these obstacles, PayTM persisted with its mission to democratize digital payments.

PayTM’s Innovative Solutions

To overcome the challenges, PayTM introduced innovative solutions such as mobile wallets, allowing users to store money digitally and make seamless transactions with just a few taps on their smartphones. This user-friendly approach revolutionized the way Indians perceived digital payments.

Expansion into the Digital Payment Realm

As smartphone penetration surged across India, PayTM capitalized on the opportunity by expanding its services beyond mobile recharges to encompass bill payments, ticket bookings, and online shopping. This diversification broadened PayTM’s user base and solidified its position in the digital payment ecosystem.

Key Features that Propelled PayTM’s Success

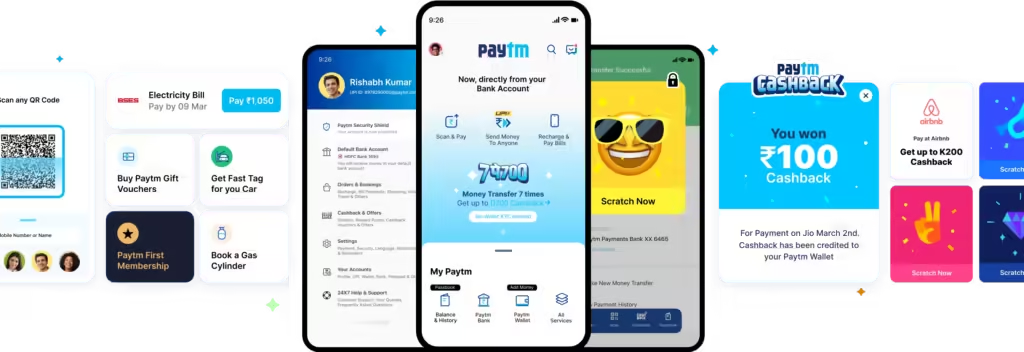

PayTM’s success can be attributed to its user-centric approach and intuitive features such as QR code payments, instant money transfers, and cashback incentives. These features not only simplified transactions but also incentivized users to embrace digital payments wholeheartedly.

PayTM’s Role in Transforming India’s Digital Payment Landscape

PayTM played a pivotal role in catalyzing India’s shift towards a cashless economy. By promoting financial inclusion and empowering small merchants, PayTM facilitated the transition from cash-centric transactions to digital payments, thereby fostering economic growth and transparency.

PayTM’s Strategic Partnerships

To further enhance its reach and offerings, PayTM forged strategic partnerships with leading banks, e-commerce platforms, and service providers. These collaborations enabled PayTM to offer a wide array of services, ranging from banking to entertainment, under its umbrella.

Competitive Analysis: How PayTM Outshone Its Rivals

Despite facing stiff competition from both domestic and international players, PayTM emerged as the undisputed leader in India’s digital payment landscape. Its relentless focus on innovation, user experience, and strategic alliances set it apart from its competitors.

PayTM’s Journey Towards Becoming a Unicorn

In 2017, PayTM achieved the coveted status of a unicorn, with a valuation surpassing $1 billion. This milestone not only validated PayTM’s disruptive business model but also attracted significant investments, fueling its growth trajectory even further.

The Future Outlook for PayTM

As PayTM continues to innovate and expand its offerings, the future looks exceedingly bright. With the rise of digital transactions and the ongoing digitization of India’s economy, PayTM is poised to maintain its dominance in the digital payment realm for years to come.

Lessons to Learn from PayTM’s Success Story

PayTM’s journey offers invaluable lessons for aspiring entrepreneurs and businesses alike. It underscores the importance of relentless innovation, customer-centricity, strategic partnerships, and resilience in navigating challenges and achieving success in the ever-evolving digital landscape.

Lessons to Learn from PayTM’s Success Story: Insights for Aspiring Entrepreneurs

PayTM’s journey from a startup to a household name in India’s digital payment realm offers invaluable lessons for aspiring entrepreneurs looking to carve their own paths in the competitive world of business. Here are some key takeaways from PayTM’s success story:

- Vision and Persistence: PayTM’s success stems from its founder Vijay Shekhar Sharma’s unwavering vision to democratize digital payments in India. He remained persistent in the face of challenges and setbacks, demonstrating the importance of staying true to your vision and persevering through adversity.

- Innovation and Adaptability: PayTM’s ability to innovate and adapt to changing market dynamics has been crucial to its success. From introducing mobile wallets to diversifying its services, PayTM has consistently stayed ahead of the curve by embracing emerging technologies and consumer trends.

- Customer-Centric Approach: PayTM’s relentless focus on enhancing the user experience and addressing the needs of its customers has been instrumental in building trust and loyalty. By prioritizing customer satisfaction and feedback, PayTM has fostered long-lasting relationships with its user base.

- Strategic Partnerships: PayTM’s strategic collaborations with banks, merchants, and service providers have enabled it to expand its offerings and reach new markets. These partnerships have not only enhanced PayTM’s value proposition but have also strengthened its competitive position in the industry.

- Embrace Digital Transformation: PayTM’s success underscores the importance of embracing digital transformation in today’s digital age. By leveraging the power of technology and innovation, businesses can streamline processes, enhance efficiency, and unlock new growth opportunities.

- Focus on Financial Inclusion: PayTM’s commitment to promoting financial inclusion and empowering underserved communities highlights the social impact potential of businesses. By providing access to digital financial services, PayTM has played a pivotal role in driving economic empowerment and bridging the digital divide.

- Agility and Resilience: PayTM’s ability to adapt to changing market conditions and pivot when necessary exemplifies the importance of agility and resilience in business. In a rapidly evolving landscape, businesses must be flexible and nimble to navigate challenges and seize opportunities effectively.

- Continuous Learning and Improvement: PayTM’s culture of continuous learning and improvement has been key to its sustained growth and success. By fostering a culture of innovation, experimentation, and collaboration, PayTM has created an environment where employees are empowered to innovate and drive positive change.

- Ethical Business Practices: PayTM’s commitment to ethical business practices and compliance with regulatory standards has earned it trust and credibility among stakeholders. Upholding integrity and transparency in all business dealings is essential for building a strong reputation and fostering long-term success.

- Global Outlook: PayTM’s ambition to expand its footprint beyond India underscores the importance of thinking globally and seizing opportunities in international markets. Businesses with global aspirations must be willing to adapt to diverse cultures, regulations, and consumer preferences.

Conclusion

In conclusion, PayTM’s journey from a humble startup to a trailblazer in the digital payment realm is a testament to the power of vision, perseverance, and innovation. By revolutionizing the way Indians transact digitally, PayTM has left an indelible mark on India’s economic landscape and continues to inspire countless entrepreneurs worldwide.

In conclusion, PayTM’s journey from a fledgling startup to a titan in India’s digital payment realm epitomizes the spirit of innovation, perseverance, and disruption. Through its unwavering commitment to simplifying transactions, fostering financial inclusion, and driving societal change, PayTM has not only revolutionized the way Indians transact but has also left an indelible mark on the global fintech landscape.

As we reflect on PayTM’s unparalleled success story, it becomes evident that its impact extends far beyond mere financial transactions. PayTM has become synonymous with empowerment, enabling individuals from all walks of life to embrace the digital revolution and participate in the burgeoning digital economy.

Looking ahead, the future holds boundless opportunities for PayTM as it continues to innovate, expand its offerings, and chart new frontiers in the digital payment ecosystem. With a steadfast commitment to enhancing user experience, forging strategic partnerships, and embracing emerging technologies, PayTM is well-positioned to maintain its leadership position and shape the future of digital payments in India and beyond.

In essence, PayTM’s journey serves as a testament to the transformative power of technology and the indomitable spirit of entrepreneurship. As we bid farewell to this captivating narrative, we are reminded that the true essence of success lies not just in achieving milestones but in leaving a lasting legacy that transcends generations.

FAQs

- How did PayTM overcome regulatory challenges?

- PayTM collaborated closely with regulatory authorities, adhered to compliance standards, and actively participated in policy advocacy to navigate regulatory challenges effectively.

- What sets PayTM apart from its competitors?

- PayTM’s relentless focus on user experience, innovation, and strategic partnerships sets it apart from its competitors, enabling it to maintain a competitive edge in the market.

- How does PayTM contribute to financial inclusion?

- Paytm’s user-friendly platform and wide network of merchants empower individuals, including those in underserved areas, to access digital financial services, thereby promoting financial inclusion.

- What are some upcoming initiatives from PayTM?

- PayTM is exploring opportunities in areas such as wealth management, insurance, and lending to offer comprehensive financial solutions to its users.

- How can businesses emulate Paytm’s success?

- Businesses can emulate PayTM’s success by prioritizing innovation, fostering a customer-centric culture, forging strategic partnerships, and adapting to evolving market dynamics.

- How does PayTM ensure the security of user transactions?

- PayTM employs robust encryption protocols and multi-factor authentication to safeguard user data and transactions. Additionally, it regularly updates its security measures and collaborates with cybersecurity experts to mitigate potential threats.

- Can PayTM be used for international transactions?

- While PayTM primarily caters to domestic transactions within India, it does offer certain international services such as remittances and online purchases. However, users should check for specific international transaction capabilities within the app.

- What is PayTM’s approach to customer support and issue resolution?

- PayTM is committed to providing excellent customer support through multiple channels, including phone, email, and in-app chat. Its dedicated support team promptly addresses user queries and resolves issues to ensure a seamless experience for all customers.

- How does PayTM contribute to environmental sustainability?

- PayTM has implemented various initiatives to promote environmental sustainability, such as digital receipts, paperless transactions, and eco-friendly packaging for its products. Additionally, it supports renewable energy projects and advocates for green practices across its operations.

- What measures does PayTM take to prevent fraud and unauthorized transactions?

- PayTM employs advanced fraud detection algorithms and transaction monitoring systems to detect and prevent fraudulent activities. It also educates users about common scams and encourages them to exercise caution while transacting online.

- Does PayTM offer financial literacy programs for its users?

- Yes, PayTM is committed to promoting financial literacy and empowerment among its users. It offers educational resources, workshops, and interactive tools to help users make informed financial decisions and manage their money effectively.

- How does PayTM ensure compliance with regulatory requirements?

- PayTM closely collaborates with regulatory authorities and legal experts to ensure compliance with all applicable laws and regulations. It conducts regular audits and reviews its policies and procedures to align with evolving regulatory standards.

- What role does PayTM play in supporting small and medium-sized enterprises (SMEs)?

- PayTM provides a range of solutions tailored to the needs of SMEs, including digital payments, invoicing tools, and business loans. It also offers marketing and promotional support to help SMEs expand their reach and grow their businesses.

- Does PayTM offer investment opportunities for its users?

- Yes, PayTM offers various investment options, including mutual funds, stocks, gold, and digital gold, through its wealth management platform. Users can invest in these assets conveniently through the PayTM app, thereby diversifying their investment portfolio.

- How does PayTM ensure accessibility for users with disabilities?

- PayTM is committed to ensuring accessibility for users with disabilities through features such as screen readers, voice commands, and customizable interfaces. It also collaborates with accessibility experts to continually improve the user experience for all users.

- What steps does PayTM take to promote responsible spending habits among its users?

- PayTM provides users with tools and features to track their spending, set budgeting goals, and monitor their financial health. Additionally, it offers educational resources and personalized recommendations to help users make prudent financial decisions.

- How does PayTM leverage data analytics to enhance its services?

- PayTM harnesses the power of data analytics to gain insights into user behavior, preferences, and trends. It uses these insights to personalize recommendations, improve product offerings, and enhance the overall user experience.

- What initiatives has PayTM undertaken to empower women financially?

- PayTM has launched various initiatives to promote financial inclusion and empowerment among women, including digital literacy programs, skill development workshops, and financial assistance schemes. It also collaborates with women-led businesses and organizations to support their growth.

- Does PayTM have plans to expand its services beyond India?

- While PayTM’s primary focus remains on serving the Indian market, it has expressed interest in exploring international expansion opportunities in the future. However, any such expansion would be carefully evaluated to ensure alignment with PayTM’s strategic objectives and regulatory considerations.

- How does PayTM foster innovation within its organization?

- PayTM fosters a culture of innovation by encouraging employees to experiment, take risks, and think outside the box. It allocates resources for research and development, organizes hackathons and innovation challenges, and rewards innovative ideas and initiatives that drive business growth and enhance user experience.